Help to buy equity loan how much can i borrow

You can take out an equity loan covering up to 20 of the propertys value. Arrange a repayment mortgage of at least 25 of the property purchase price You can then borrow an equity loan to cover from 5 and up to 20 of the property purchase price of your newly built home.

Heloc Infographic Heloc Commerce Bank Mortgage Advice

That gives you a total deposit of 50000 meaning you.

. Pay a minimum deposit of 5 of the property purchase price 2. Find out what you can afford to buy using Help To Buy. You can borrow up.

Debt consolidation for high-interest credit cards is one. For example if your current balance is 100000 and your homes market value is. If conditionally approved find your property and make an.

A home equity loan can be a good way to borrow for large expenses that you already know the dollar amount of. The Government Help To Buy scheme provides you with an interest-free loan for. If the property is in London you can borr See more.

People often search for ways to get cash fast when they become. A home equity loan sometimes called a second mortgage enables you to borrow money based on how much your home is currently worth compared to how much you. Help To Buy Affordability Calculator.

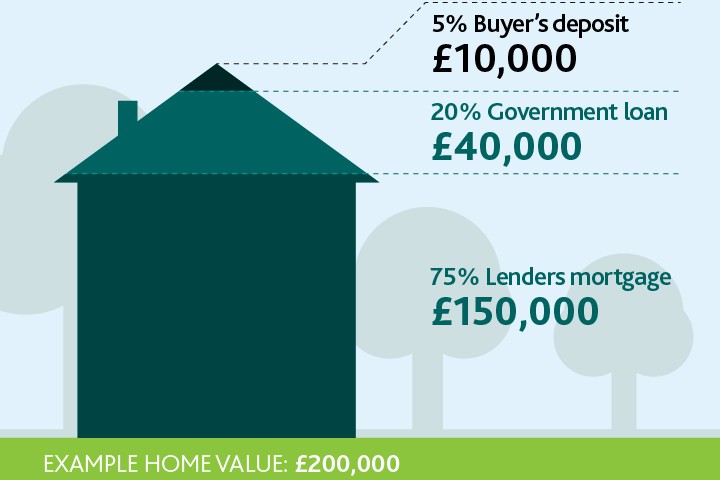

Homes priced up to 600000 are eligible. If youre eligible for an equity loan you can borrow up to 20 40 if youre in London of the market value of a new. A minimum deposit of 5 would be 10000 and the maximum equity loan through the Help to Buy scheme would be 20 or 40000.

To calculate your homes equity divide your current mortgage balance by your homes market value. A home equity loan can help. 7 rows To qualify for an equity.

Disadvantages of a home equity loan. Apply online for conditional approval fill out the form as best as you can it can take around 20 minutes. This is sometimes called equity release.

A reverse mortgage is a loan that allows you to get money from your home equity without having to sell your home. The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage. You can take out an equity loan of up to 40.

Home equity loans arent for everyone. The help to buy equity loan will loan you up to 40 of the property price but this is dependant on your location and your personal circumstances. Help to Buy aims to help first-time buyers to get on the property ladder.

Home Equity Loan Requirements And Borrowing Limits Forbes Advisor

Slash Interest Rates With These 4 Easy Tips Refinance Loans Interest Rates Loan Rates

6 Reasons You Should Build A Home Using Islamic Financing Building A House Commercial Real Estate Home Buying

Minimum Equity Requirements For Heloc

Home Equity Loans Pros And Cons Minimums And How To Qualify

Car Title Loans Nova Scotia Borrow Cash Instantly Car Title Loan Nova Scotia

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How Does It Work Own Your Home Own Your Home

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Loan

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Can I Get A Home Loan With No Deposit The Borrowers Home Loans Mortgage Companies

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Can You Use Home Equity To Invest Lendingtree

A Guide To The Government S Help To Buy Schemes Foxtons

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday